One of India’s first smart mobility solutions, Bounce, has announced its partnership with a “Super App” called ‘Park+.’ With this partnership, the two companies will strengthen the EV ecosystem across India by installing 3,500+ battery swapping stations. The two companies will place the smart framework across residential societies, key parking spaces, malls, and corporate offices. Customers across 10 cities will be able to find their nearest swapping station by using the Bounce or Park+ app.

According to Bounce, the partnership will help create a battery swapping infrastructure for over a million e-scooters in 2 years. Park+ states that it aims to revolutionize its user’s experience via a technology-enabled ecosystem solution and a scaled-up charging infrastructure. According to Park+, the widespread EV proliferation is typically hindered by the absence of charging infrastructure, which requires mitigation. The overall partnership aims to facilitate and enhance the advantages of EVs for the future.

What is the ‘Battery as a service’ option?

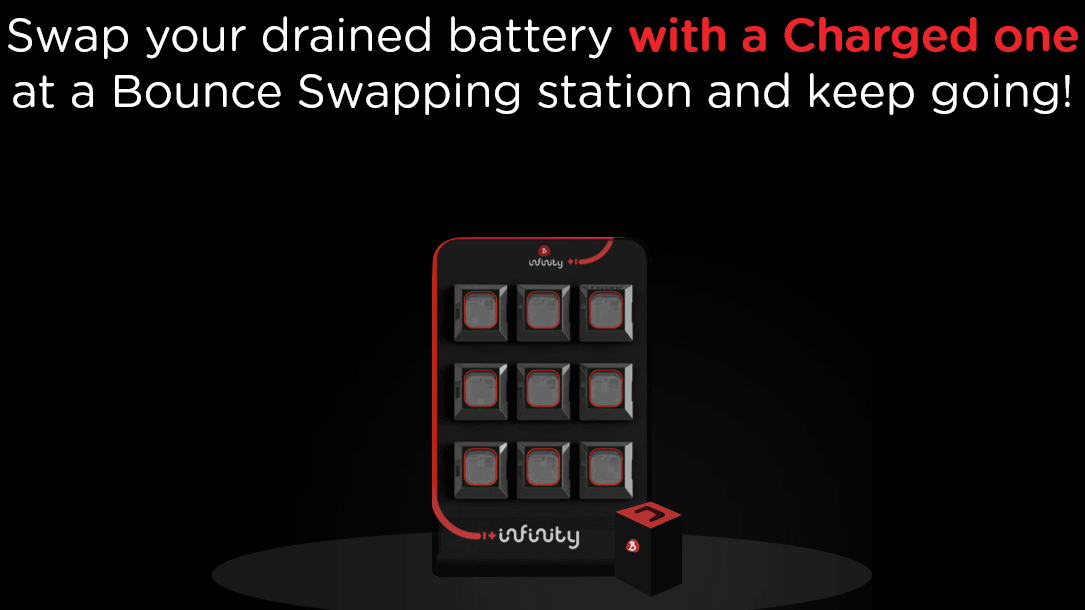

On December 2nd, 2021, Bounce will launch its first electric consumer scooter called the Bounce Infinity in the Indian market. Along with the e-scooter, the brand will also launch its unique, one-of-a-kind ‘Battery as a service’ option for its customers. With this service, customers can swap their e-scooters’ empty batteries for fully-charged, ready-to-go batteries at Bounce’s battery swapping stations. This service option will significantly reduce the anxiety felt by customers who forgot to charge their batteries and waiting times.

What is Park+?

By building a Super App for Indian car users, Park+ aims to solve everyday problems faced by car owners. This includes building technological solutions for parking, FASTtag, and access control in malls, corporate parks, or apartments. The organization also allows its users to discover, book, and pay for parking at approximately 90,000 slots across the country. Recently, Park+ raised USD 25 million at a Series B funding round. This funding round was co-led by companies such as Sequoia Capital India, Matrix Partners India, and Epiq Capital.

Also Read: Electric Mahindra XUV300 could be called XUV400